What will Smile’s disappearance do to Amazon’s EBITDA and stock price?

Look at these Amazon Smile Screenshots:

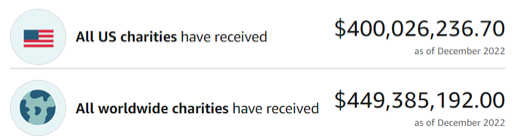

The end of year screenshot for 2022

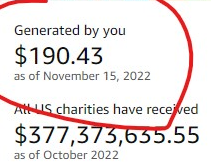

End of October 2022

That means the US donation total for 2022: $400,026,236.70. Plus two months between October and end of December 2022 generated $22,652,601 in Amazon Smile US donation revenue, driven by US Amazon Smile shoppers. Admittedly, that number represents the peak shopping season, Q4. However, the annualized forward looking 2023 donation estimate based on $22.6 million for 2-months could easily result in a 2023 number of $125, $140 or with growth in Smile participation, even $200 million in annual donations driven by Smile shoppers. Inflation and Amazon’s continued retail dominance support that hypothesis.

Let’s use conservative estimates. $125 million in donations driven from the buying behavior of Smile shoppers means that those shoppers represent $25,000,000,000 in Smile-related 2023 US sales…

Estimates of 2023 Amazon eCommerce revenue are in the range of $230 billion. Could 10% of eCommerce revenue be the result of shoppers opting into Smile. What if Smile shoppers tend to be more affluent, bigger spenders? Smile donation levels were set at (50 basis points) .5% and with ecommerce revenue of $35 billion attributable to Smile, that is material when it drops to the bottom line, but the .5% dropping to the bottom line only happens if Smile shoppers stick with Amazon.

What will Smile’s disappearance do to Amazon’s EBITDA and stock price?

Scenarios:

- Shopper behavior doesn’t change. All $125 million fall to the bottom line as profit. Amazon is a company that measures eCommerce EBITDA or loss in basis points, this is material, and probably the reason Smile was canceled. Prime has habituated shoppers to Amazon.

- Some shoppers are not loyal to Amazon and are upset. Those shoppers, businesses and nonprofits discover the Giving Forward nonprofit Charity Mall, iGive, GooodShop or GivingAssistant (formerly a nonprofit as far as I can tell) and the merchant relationships there, and change their buying behavior.

- High spending shoppers move to alternative charity malls and platforms.

Number 2 is most likely. Time will tell.